Solar feed-in tariffs were once the most influential factor in a given state’s rooftop solar market, but all of the generous rates once available have been closed to new applicants. Households and businesses who are receiving these incentives applied for them before a deadline (different in each state) and will continue to reap the benefits until they either move house or until the scheme ends – with big implications for the future uptake of energy storage. In this article we provide a state-by-state recap of when these schemes wrap up.

This article is focuses mainly on historic feed-in tariff rates which are not available to new solar customers. If you’d like to see current rates, please visit our Solar Feed-in Tariff Rewards page.

Australian Capital Territory

Australian Capital Territory

Scheme name(s): ACT Small-scale Feed-in tariff (0-30kW); Medium-scale Feed-in Tariff (30-200kW) and Large-scale feed-in tariff (200kW+)

Historic rate(s) paid: 47.5c/kWh (Original small-scale, closed 31 May 2011); 30.16c/kWh (Medium-scale, which was later briefly expanded to include small-scale, closed 14 July 2011)

Type (gross or net): Gross

Date scheme ends (payments cease): 20 years after date of connection

Benefits transferable to new occupants if home is sold or rented? Yes

Current rate paid to new solar homes: Voluntary retailer contribution for small & medium-scale – no mandatory minimum solar payment; the large-scale feed-in tariff is still active, with a rate determined on a project-by-project basis by reverse-auction feed-in tariff.

Comments: The long duration of the ACT’s feed-in tariff payments, plus the fact that they are generous and paid out on a gross basis (i.e. all solar energy is exported by default), the fact that payments are transferable between home occupants means that there will be little financial incentive for a ACT home or business to opt for batteries to increase their energy self-sufficiency level in the near future.

Further info: ACT Environment and Planning Directorate – Rooftop Solar

New South Wales

New South Wales

Scheme name(s): NSW Solar Bonus Scheme

Historic rate(s) paid: 60c/kWh (Application submitted by 27 October 2010), 20c/kWh (Application submitted by 28 April 2011)

Type (gross or net): Gross (customers on the 20c/kWh rate are encouraged to switch to net metering to maximise value)

Date scheme ends (payments cease): 31 December 2016

Benefits transferable to new occupants if home is sold or rented? For 60c/kWh rate recipients, benefits will be lost with the transfer of energy account from one name to another (e.g. house is leased or sold). For 20c/kWh, on the other hand, the NSW Department of Industry, Energy and Resources indicates that in most cases payments are transferable even with a name change.

Current rate paid to new solar homes: Voluntary retailer contribution – no mandatory minimum solar payment (generally around 6-10c/kWh)

Comments: Once Solar Bonus Scheme payments cease at the end of 2016, it will be in the financial interest of all solar system occupants to have a net electricity meter installed. It is also expected that many of the 160,000 homes currently benefiting from this scheme will look towards battery storage to cut their losses.

Further info:

- NSW Department of Industry, Energy and Resources – Solar Bonus Scheme

- Solar power in NSW

- Energy storage in NSW after the Solar Bonus Scheme ends

Northern Territory

Scheme name(s): Solar Buyback through PowerWater

Current rate paid to new solar homes: 1-for-1 (equivalent to retail tariff rate)

Type (gross or net): Net

Date scheme ends (payments cease): N/A

Benefits transferable to new occupants if home is sold or rented? N/A

Comments: PowerWater offers the most generous solar feed-in incentive in the country, so there is little incentive for grid-connected solar homes to invest in batteries at this point.

Further info:

Queensland

Queensland

Scheme name(s): Queensland Solar Bonus Scheme

Historic rate(s) paid: 44c/kWh (applications in and system installed by 9 July 2012); 8c/kWh (applications in after 9 July 2012)

Type (gross or net): Net

Date scheme ends (payments cease): 1 July 2028 (44c/kWh rate); 8c/kWh rate has already expired

Benefits transferable to new occupants if home is sold or rented? No (except between spouses)

Current rate paid to new solar homes: Southeast Queensland: Voluntary retailer contribution – no mandatory minimum solar payment; Regional Queensland: Rate set by regulator, currently around 7c/kWh.

Comments: The long duration of Queensland’s Solar Bonus Scheme means that recipients are unlikely to be interested in energy storage unless they move into a home with a preexisting solar system. For new solar homes, increasingly strict grid connection rules (including a push for the installation of export control devices) may mean that energy storage may already be a real consideration.

Further info:

- Department of Energy and Water Supply: Solar Bonus Scheme

- Solar power in Queensland

- Energy storage in Queensland

South Australia

South Australia

Scheme name(s): Solar feed-in scheme

Historic rate(s) paid: 44c/kWh (application in by 30 September 2011); 16c/kWh (application in by 30 September 2013)

Current rate paid to new solar homes: A ‘minimum retailer payment’ may be available through your electricity retailer

Type (gross or net): Net

Date scheme ends (payments cease): 30 June 2028 (44c/kWh); 30 September 2016 (16c/kWh)

Benefits transferable to new occupants if home is sold or rented? Yes

Comments: Because of the long duration of the scheme, South Australians on the 44c/kWh feed-in tariff are unlikely to be motivated to install battery storage unless they move house. However, those on the 16c/kWh rate may begin to consider batteries even before the 16c/kWh rate expires on 30 September.

Further info:

- SA government: Solar Feed-in Scheme

- Solar power in South Australia

- Battery storage in South Australia

Tasmania

Tasmania

Scheme name(s): Aurora Energy Net Metering Buyback Scheme; Transitional Feed-in Tariff

Historic rate(s) paid: 1-for-1 (equivalent to retail tariff rate) through Aurora Energy (applications in by 31 August 2013)

Type (gross or net): Net

Date scheme ends (payments cease): 31 December 2018

Current rate paid to new solar homes: Determined by regulator, but in the range of 5-7c/kWh

Benefits transferable to new occupants if home is sold or rented? No (except between spouses)

Comments: The announcement of the closure of Aurora Energy’s solar buyback scheme to new entrants sparked a burst of installations in the state, but other than that the Tasmanian solar market has always been small due to both small population and lower solar resources. Energy storage may become financially attractive to solar homes on the Transitional FiT once they lose this benefit at the end of 2018.

Further info:

- Office of the Economic Regulator – Feed-in Tariffs

- Aurora Energy – Solar Feed-in Tariff FAQ

- Solar power in Tasmania

Victoria

Scheme name(s): Premium Feed-in Tariff for Solar; Transitional Feed-in Tariff for Solar; Standard Feed-in Tariff

Historic rate(s) paid: 60c/kWh (Premium FiT – applications in by 29 December 2011); 25c/kWh, 1-for-1 (Transitional & Standard FiTs, respectively – applications in by 31 December 2012);

Type (gross or net): Net

Date scheme ends (payments cease): 2024 (Premium FiT), 31 December 2016 (Transitional FiT, Standard FiT)

Benefits transferable to new occupants if home is sold or rented? Yes for Transitional and Premium FiTs; No for Standard FiT. (Read more.)

Current rate paid to new solar homes: Voluntary retailer contribution – no mandatory minimum solar payment (generally around 6-10c/kWh)

Comments: The cessation of Victoria’s Transitional and Standard FiTs at the end of 2016 will likely result in at least some of those households seeking energy storage to avoid ‘wasting’ their solar energy by exporting to the grid at new, presumably low rates. For this reason, Victoria has been identified as the second largest potential market for energy storage in Australia after NSW.

Further info:

- Victoria Department of Energy and Earth Resources – Closed Feed-in Tariff schemes

- Victoria Department of Energy and Earth Resources – Current Feed-in Tariff

- Solar power in Victoria

- Energy storage in Victoria

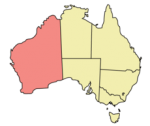

Western Australia

Scheme name(s): Western Australia Solar Feed-in Tariff

Historic rate(s) paid: 40c/kWh (applications in by 1 July 2011); 20c/kWh (applications in between 1 July 2011 and 1 August 2011). An additional 7c/kWh ‘solar buyback’ was available for Synergy customers.

Type (gross or net): Net

Date scheme ends (payments cease): 10 years from installation

Benefits transferable to new occupants if home is sold or rented? No

Current rate paid to new solar homes: Varies sharply by region for Horizon Customers, Synergy offers around 5-8c/kWh

Comments: WA is something of a wildcard when it comes to energy storage. Feed-in tariff payout durations are long, and despite the fact that generous solar buybacks are still on offer in some areas, the sprawling Horizon grid has strict requirements for solar grid connection. This, combined with high retail electricity prices could mean that homes find it worth their while to produce and store their own solar energy.

Further info:

- WA Department of Finance – Residential Feed-in Tariff scheme

- Horizon Power – Pricing and buyback schemes

- Feed-in tariff eligibility for Horizon Customers

- Solar power in WA

© 2015 Solar Choice Pty Ltd

- Solar Hot Water System: Everything You Need to Know - 27 February, 2024

- Enphase Battery: An Independent Review by Solar Choice - 20 January, 2024

- Can I add more panels to my existing solar system? - 8 August, 2023

My contract with Origin is 60 cents plus 6 cents until November 2024. Can I change providers without risking my 60 Cents ?

Hi Rod,

My understanding is that you are free to switch electricity retailers/providers without losing your feed-in tariff. However, the actual rate backed by the QLD government is 44c/kWh – in your case Origin kicks in an additional 16c/kWh. So if you wanted to switch you’d need to work out which companies (if any) also offer 60c/kWh. You can go to EnergyMadeEasy.gov.au or Wattever.com.au to compare different plans & feed-in rates. Also make sure you confirm that switching will not put your rate into jeopardy (I’m pretty sure it won’t, but you’ll want to get that confirmation in writing from the company you want to switch to – if any.)

I have a 3 kW system installed 7 years ago am getting 47 c rebate if I increase to 5 or 6 kW will I lose my rebate .i am in Perth wa

Hi John,

As we understand it, in WA you can increase your solar panel array size but not your inverter size (read more here). There is, however, a technical limit to how much panel capacity you can add to an inverter and still have it operate optimally (read about ‘overclocking’ here).

Hope this helps.

I am from WA and are being refunded the old 40 cents/Kw hour. The system has a 3 Kw inverter but only 6 panels (1.5Kw) on the roof. I have been told if I put another 6 panels on the roof to bring it up to 3 Kw to match the inverter I will still get the 40 cent rebate as long as I do not change the inverter. Is this correct.

HI Frederick,

I would double check with the WA state government about it, but yes our understanding is also that it’s fine to expand the solar panel array as long as you don’t increase the inverter size.

See our article on the topic here, or refer to the WA Dept of Finance residential solar Q&A page here.

Hope this helps!

About a year ago my retailer without warning reduced my FIT from 33cents to 8cents and when questioned they said don’t blame us blame the state government. Is this correct or are they just avoiding the tariff? I was under the assumption that my FIT was garaunteed for 25 years.

Hi Harry,

What state are you in?

I have also had this problem, I am from Victoria, our system was installed on Dec 13th 2011. We had a rebate of 33censt and thought it was for 25 years

Hi Katrina,

From what we understand, the payments for your system should continue until 2024 – not quite 25 years, but close. Are you not currently receiving payments?

Many many thanks, that detail is exactly what I needed.

Please confirm if in Victoria the Premium FiT is transferable if the property is sold. The question doesn’t appear to have an answer on your website.

Hi Tracy,

I’ve just updated the article with the answer. Yes, the Premium FiT and Transitional FiT are transferrable. The Standard FiT is not. (Please see here for more details on the Victorian government’s website.)